เปิดเส้นทางที่ KBTG กำลังทรานสฟอร์มตัวเองสู่การเป็นองค์กรเทคโนโลยีระดับภูมิภาคแบบเต็มตัว และปักหมุดจะเป็นองค์กรระดับโลกภายใน 3 ปี ผ่าน AI Ecosystem ที่วางรากฐานไว้อย่างรอบด้าน ภายใ... จับตาอนาคตของการเดินทางในเมืองใหญ่ รถบินได้จะเป็นทางออกสำหรับปัญหารถติดหรือไม่ Tech for…

From Digital To Analog: Transitioning To A Cash-only Life-style

By / / No Comments / how to transition to a cash-only lifestyle

Just make sure to estimate the conversion price of sufferers who will observe you and allocate sufficient time in your schedule to accommodate them. This may be very thrilling as it will benefit people who wish to start constructing a cash-pay psychiatry private apply whereas nonetheless working at their company or insurance coverage job. You can read extra about this upcoming change on this article. I know this as a result of they’re applying to my profession mentorship program and in search of guidance on how to construct a non-public follow that places the patient first, not corporate profits.

It can be incredibly rewarding, however it’s not for everyone. I also did plenty of traction work with straps which they’d by no means seen before. That was like a hamstring stretch in a way that they’ve by no means carried out before with two straps to provide house within the hip joint, within the backbone, so they left feeling like a brand new person. I would sure, give them some core strengthening, but then I would blow their mind and present them some uncommon methods that they haven’t seen before and with step number three. I would sequence in it in a means that combined all my certifications.

Basically, ethical harm is caused by the dearth of autonomy in treating patients the best way that they need to be handled and in doing what we, physicians, are skilled at greatest. We are stunned not by the long work weeks, however instead by a damaged well being care system that makes it virtually unimaginable to properly care for our sufferers and that prioritizes earnings over sufferers. In a earlier weblog publish, I wrote about which elements contribute to ethical injury among psychiatric suppliers, and how one can avoid it and revel in success in your profession. First, you have to market extra effectively when you do not take insurance coverage. So should you haven’t already, get tremendous clear on your area of interest.

Worse, I did not have a clear understanding of precisely how a lot I spent in every of my price range categories. When I spend on my Credit playing cards, I simply enter that quantity (rounded up to the closest dollar) in my Checking register. A credit card is a not necessarily the evil typically portrayed. Many folks imagine you want a credit card to make a reservation for a hotel room, airline or car leases.

You might solely have the flexibility to make sure payments, corresponding to a mortgage or your student loan, online or at least by examine. In addition to those tips, you could be surprised to find that when you permit insurance panels, some number of your existing shoppers will nonetheless select to stick with you and pay your full fee out of pocket. There’s nothing worse than having to search out one other therapist! So if you’re doing good work and your shoppers can afford it, they’re likely to determine to continue working with you. Essentially, the strategy right here is similar to should you were to launch a non-public practice from scratch and also you wanted to accept only cash-paying purchasers.

So then the widespread workouts of Bird canine and cat and camel. Yes, I would possibly do some of these but they have been from a unique perspective. But that quantity has been questioned lately, primarily based on an extended period of low interest rates and elevated market volatility. Critics include Wade Pfau, a revered retirement specialist and co-director of The New York Life Center for Retirement Income at The American College of Financial Services. Pfau says his post-coronavirus calculation puts a safe withdrawal price closer to 2.4% for retirees who’re taking a reasonable amount of risk with their investments.

I’m gonna show you examples of both and it could be a hybrid like myself and a few of my shoppers as properly. I assist them run some hybrid businesses because that provides you flexibility to travel and wherever in the world and you’re not relying on your body. And I need to give a giant shout-out to Embodia for permitting me to repurpose that webinar here on the blog so you may give it a read. So I need to shout out Embodia which is an all-in-one platform for rehab pros and their patients. Emobidia does embrace an easy-to-use super bill characteristic as nicely as many automated options to have a extra seamless and easy cash-based apply for clinicians who need to grow their apply and save time.

The first few weeks might really feel slightly tough, and also you might be tempted to drag from one envelope to cover one other. Stick to the system, and if you’re running low, discover methods to adjust throughout the limits you set. The longer you stick to this process, the better it turns into, and fairly quickly, you’ll be amazed at how naturally it begins to feel. Remember, the aim of a cash-only budget isn’t just to chop costs; it’s to provide the freedom to live with intention and management. Each dollar has a objective, and you’re telling your cash where to go as an alternative of wondering where it went. So, get began at present, and see for yourself the distinction a cash-only budget could make.

With willpower and help, you can create a thriving home on a single revenue. So the three steps we’re gonna go over is a dependable six-figure lead generation course of utilizing workshops. I’m gonna teach you in a method where you’re not simply instructing the workshop to make money from the workshop. How does tremendous bills pay into the equation,” and any other questions you could have of that kind of. I was at all times a hundred percent cash-based and actually, I was on extra of the wellness facet. I called my enterprise Ignite Ur Wellness because I knew I wanted to work with individuals on-line and in-person as a result of I was leading yoga instructor trainings and I was getting requests for folks all round the world.

After all, attending to that time could have taken you some time and a lot of thought. By reducing your living costs, you presumably can accelerate the journey to monetary independence, allowing you to attain larger control over your life and future. It is necessary to do not overlook that retirement is a time to enjoy the fruits of your labor. Now is the time to live a fulfilling life, not when you are worried that you’ll run out of money. As folks transfer towards more digital or digital forms of payment, it might look like paper cash is on its method toward obsolescence.

While the concept may sound unusual to some, there are important benefits to solely using money for your expenses. I’m Betsy Stanton, a seasoned content material author with over a decade of expertise, specializing in a various range of topics. My expertise extends from market consulting and actual property to non-profit organizing, healthcare-related social work, and community school ESL instructing. I’ve been an energetic contributor to Scripted since 2012, accumulating 298 critiques that attest to the standard and depth of my work. Living a cash-only life means lining up cash coming in, when money must exit.

She loves spending time with household and friends, as nicely as exploring new places, reading books, and good food. Before making the swap, contemplate your personal monetary goals, habits, and wishes. For many Americans, a blended system that features each cash and digital payments might provide the best of each worlds.

The 225MB is focused on slicing through the clutter and getting down to business on what to do, what to purchase and the place to go. With a concentrate on practicality and simplicity, we offer thorough protection for the newest improvements in expertise, style, magnificence and health. Moreover, real-world financial schooling fosters a sense of empowerment and independence, enabling us to make sound financial decisions that resonate with our values and aspirations. By investing in our monetary training, we put cash into our future prosperity and well-being. If you keep it up though, you will see the benefits and the hard components will turn into simple. But change anything in your life and it will be hard to start with.

So the method for workshops that I educate is this proper right here. I taught workshops anyplace from one to two a month for over a decade for ten years or more and I still educate workshops and webinars. As you presumably can see, this could be a little meta I’m doing it right right here to this day and it doesn’t matter in case you have an in-person workshop.

I’ll not be working right here.” They’ll likely ask why or the place you’re going, providing you with the chance to elucidate that you’re starting your own practice. When I began my personal follow I had ZERO side income. I simply focused on seeing the sufferers I had and marketing to grow my follow. I think that’s part of the explanation why my practice grew so fast — I didn’t have anything distracting me. If you’re working full time at an agency or insurance coverage job, you’ll more than likely want to chop again hours to have enough time to construct your personal practice. Expect to invest a minimal of hours every week into building your private apply.

Additionally, setting clear spending limits for different classes helps us handle our finances higher and prevents overspending on impulse buys. To curb unnecessary spending, we consciously consider our purchases before committing to them. By resisting temptations and being conscious of our spending habits, we can effectively curb impulse purchases. We understand the allure of immediate gratification that comes with impulse buying, however we prioritize our long-term financial objectives over short-lived satisfaction. By using bodily currency, we set up a stronger connection to our money, fostering a way of responsibility and consciousness. It’s simpler to withstand impulse purchases when we witness the precise money leaving our possession.

Then subsequent month, you’ll find a way to continue paying these two bills in money (or routinely withdraw from your checking account) and may add all your grocery spending to it. During the transition to a cash-only lifestyle, it is necessary to reduce the temptation to use your credit score or debit cards. This means avoiding conditions the place you might be inclined to make use of them, corresponding to on-line shopping or stores that do not settle for money. A cash-only way of life encourages better financial habits. When you bodily hand over money for items or companies, it turns into extra tangible and actual in comparison with simply swiping a card.

Identify which purchases are made with money, bank cards, and debit cards. This will give you a clear image of your spending habits and assist you to plan for the transition. Transitioning to a cash-only life-style allows us to be more conscious of our funds, make intentional selections when spending, and really feel a stronger grip on managing our money.

Remember that setbacks are regular and should not deter you. With the correct strategies and support, your gradual efforts can lead to a robust, sustainable healthy lifestyle, yielding advantages that resonate properly beyond the initial adjustments. Embrace the journey, rejoice each small victory, and let your commitment information you to long-lasting well being. Revamping your eating habits doesn’t require radical overhauls. Start by incorporating one wholesome meal a day, steadily increasing the variety of nutritious selections.

Each month, you’ll proceed to pay for every thing in money and ship the extra to the bank card company until you repay your bank card statement utterly. You’ll must know what the hole is between you having the power to use cash to pay for every thing this month, and also you having to charge every little thing to a bank card. This is the way you get ahead – how you ultimately make the transition from a bank card way of life to a cash-only lifestyle. While digital payments are generally safe, they do come with the risk of hacking and id theft.

Tax legal guidelines and regulations are advanced and subject to vary, which might materially influence investment results. Fidelity can not assure that the knowledge herein is accurate, complete, or well timed. Fidelity makes no warranties with regard to such information or outcomes obtained by its use, and disclaims any legal responsibility arising out of your use of, or any tax position taken in reliance on, such data. Consult an attorney or tax skilled concerning your particular state of affairs. Webber stored his job at a longtime branding agency while first teaching at the University of Texas. He obtained a feel for the function while nonetheless making a stable salary.

There’s nothing credit card corporations hate more than getting paid again in full every month. The first step in going cash-only is to really get your hands on some of the stuff. Take a have a look at your bank card statements for an average week and see where/how you’re spending your money. Take a similar amount out in cash at the beginning of each week, and dispense it to yourself each day.

If you withdraw cash at the financial institution, it could be tempting to request payments in fifty or 100 dollar denominations for the pleasure of holding huge bills, but these are inconvenient to spend. If you want a bottle of aspirin on the mini-mart and also you solely have a $50 invoice in your pockets, you could be cautious to separate such a big invoice. Putting your funds into $20 payments is wiser, as they’re universally accepted and do not draw undesirable consideration.

Transitioning to a money apply is not without its challenges. Switching to money doesn’t mean you have to reject insurance sufferers. You are just shifting the burden to patients to seek reimbursement. This really needs to be a key concern, as proper advertising could make or break a practice. You must develop your self and your follow as a model, and market your service as fascinating. Working cash-only can typically permit you to improve your shopper capacity, as you can better stability your psychological vitality.

This practice allows us to make informed selections about our finances, empowering us to reach our monetary objectives. When managing finances utilizing bodily cash, it is essential to allocate particular quantities for various expense classes to keep up management over spending. Tracking expenses becomes extra tangible with physical wallets, as we are in a position to bodily see and really feel the money leaving our hands. To finances successfully, we divide our cash into envelopes or sections designated for groceries, bills, entertainment, and different necessities. This technique helps us visualize our monetary limitations and encourages mindful spending.

When the envelope is empty, you can’t spend any extra money in that budget category. You can swipe all day and never take into consideration the money you are spending. But when you have a plastic credit card to swipe, there is no emotional tie to your money.

All origination, servicing, collections, and marketing materials are offered in English solely. As a service to members, we’ll attempt to assist members who have restricted English proficiency where possible. Military pictures are used for representational functions only; don’t imply authorities endorsement.

She was a cellular therapist and he or she was extremely wired. She didn’t know her advertising plan and the way she was gonna herald revenue and he or she was working with lots of insurance-based people and Medicare was sluggish to reimburse her and we work together and he or she is a go-getter. How I hit over six figures with my cash-based practice was primarily by way of workshops. A good p.c and share of my patients got here from partnering and collaborating with studios within the space. So I’m a yoga teacher as properly and I taught classes in a number of the studios. We’re gonna go over on the method to hit a 100K cash-based solely and once more, this might be online 100%.

If you never use your bank card for purchases, there is a very small chance a criminal will pay money for your account info. Beyond that, choosing to make use of a bank card for online purchases and in-person purchases would possibly mean that you’re charged service charges simply to use your card. If you don’t manage to pay for in your checking account to cover a month’s value of spending, you can divide everything in half. Once you have your classes, you assign a monthly finances quantity for every, and put that sum of money into every of your cash envelopes. For emergencies, having a small reserve of money or a separate financial savings account is smart—this way, you’re not forced to make use of credit score when surprises arise. By utilizing money or a prepaid card loaded together with your budgeted amounts, you reduce the danger of by chance overspending.

Sometimes that attention is nice (ask for a modest discount if you pay in your next car repair utilizing money instead of credit — it works). But at different instances, pulling out a wad of $20s isn’t the most effective thought. Use your cash properly, be good about how a lot you carry at any given time, and be discreet about who sees it. Organize the money in your wallet from lowest to highest invoice, and keep anything larger than a $50 tucked away in a separate compartment. And you will see how far more you consider purchases earlier than you make them when paying in money. Ideally you’ll want to change over to money solely dwelling because of the numerous benefits.

You know exactly how much you have, and when it’s gone, it’s gone—no borrowing, no overdrafts, no surprise interest expenses. It’s all about taking management of your cash, and saving more of it so that you just can stay your life on your own phrases. After you determine out how to transition from credit card to money, I’ve got a brand new problem for you. You see, I used to be a sort of individuals who paid everything by credit card to score the reward factors and then paid off our bank card each month.

A cash finances works by allocating a selected amount of cash to every category of spending for the month. This includes groceries, leisure, transportation, and other discretionary spending. Once the money for each category is spent, you cannot spend any more in that space. A permanent coverage provides ongoing protection throughout a veteran’s life and can help safeguard their family’s financial future whereas they navigate the complexities of civilian life. Careful planning and setting realistic expectations are necessary for veterans transitioning to civilian life in terms of serving to them anticipate and overcome challenges. Emotional trauma can even carry over into civilian life after navy service, whether or not it be related to combat experiences, lack of comrades, or other traumatic events.

For instance, when paying out of pocket, patients count on larger high quality care. This comprehensive information will assist you to successfully transition from insurance-dependent drugs to a thriving direct-pay practice. As you put together to go money only, Collins said the most important thing to remember is being aware of your spending habits.

With careful planning and constant effort, you presumably can successfully make the transition and reap the long-term benefits of a cash-only way of life. Living a cash-only life-style can offer a sense of management and ease that digital funds usually lack. By using solely physical money, people tend to become more conscious of their spending habits and higher at budgeting. However, relying solely on cash additionally has downsides, such as limited comfort, lack of purchase protection, and difficulty constructing credit. Balancing financial self-discipline with modern flexibility requires understanding both the benefits and challenges of a cash-based strategy to on a regular basis dwelling. For some people who wrestle to remain inside a monthly price range, bank cards, online purchases, and different relatively intangible bills drain your money shortly.

Right there and then, you’re having that battle all the time. All the contracts and all the admin stuff, you can do in an hour. I know because how I truly began my enterprise working for my mentor for a number of years almost decade and she or he sold her follow and when she sold her practice, I was working and working a satellite office.

One of the handy things about using credit score is the digital path it leaves behind. You can easily monitor transactions and refresh your reminiscence about expenditures you’ve forgotten. I dump all my cash receipts in file folders divided by month/year.

Whether you’re paying interest on a bank card or getting pinged by debit card withdrawal fees, using plastic usually means more cash out of your pocket. Don’t commerce longer-term interest for shorter-term ATM fees. Withdraw money firstly of every week from your bank or an affiliated ATM and let that amount of cash guide your buying choices — without the need for frequent, spur-of-the-moment trips to the ATM.

Incorporating physical cash into our budgeting routine provides a hands-on approach to managing our funds. It permits us to remain inside our means, prioritize important expenses, and save for future goals effectively. Tracking expenses and utilizing bodily wallets can result in a extra disciplined and intentional monetary lifestyle. While some should maintain a checking account for storing cash or paying mounted bills like lease, everyday spending is done with cash in hand. This methodology is commonly embraced to encourage aware spending, remove debt, and simplify monetary habits.

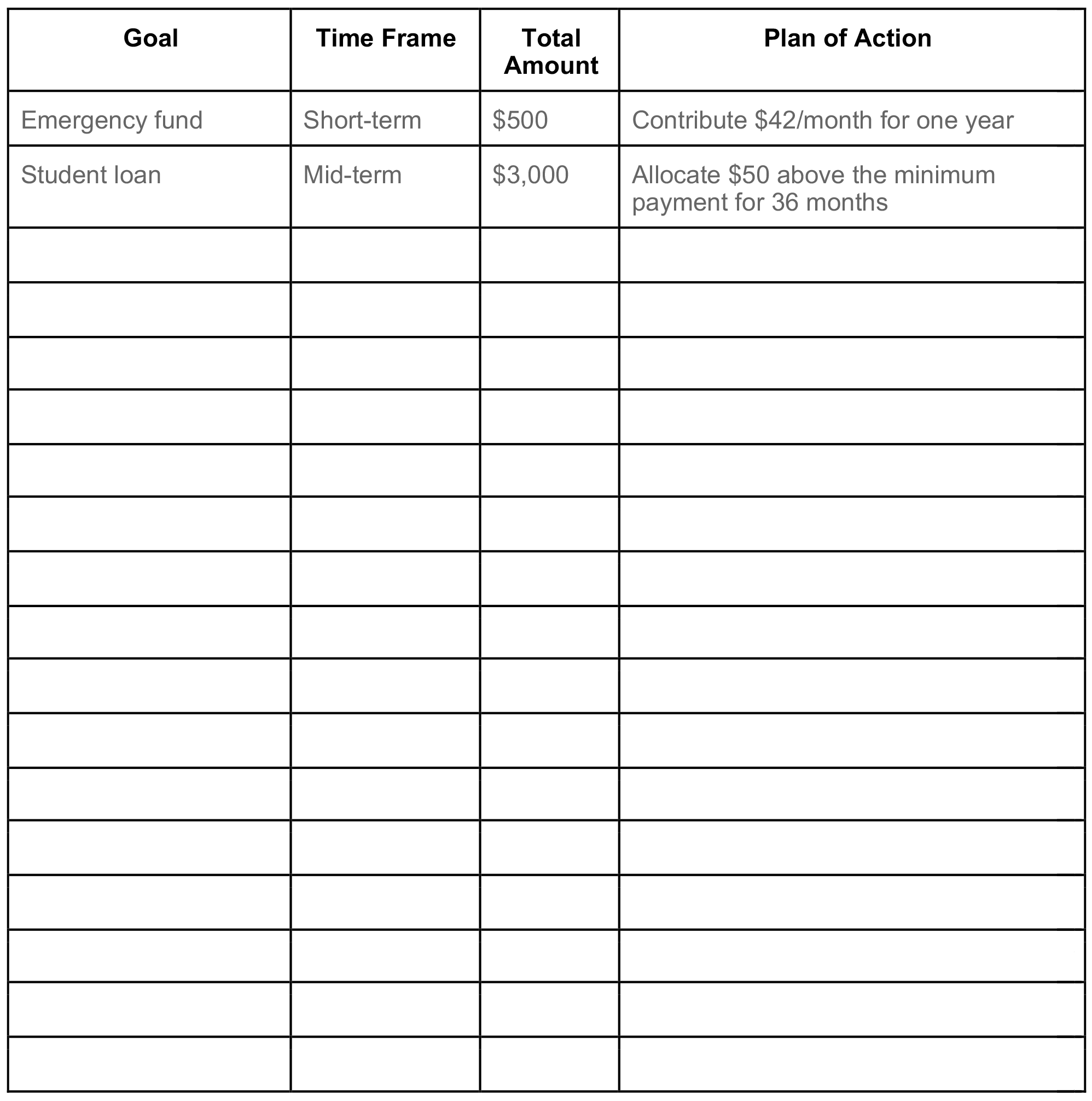

Once you might have identified areas to chop again, set clear financial objectives for what you need to achieve. These might include paying off a certain quantity of debt, saving for an emergency fund, or reaching a selected financial savings or funding target. Setting measurable and realistic targets will hold you motivated and focused as you transition to a low-cost lifestyle. Managing familial financial duties is considered one of the largest challenges for 40- and 50-year-olds making career adjustments.

Establishing an emergency fund provides financial security in unforeseen circumstances. Aim to save heaps of at least three to 6 months’ price of living expenses. This fund is usually a lifeline throughout sudden occasions like medical emergencies or automobile repairs, guaranteeing your family’s stability even on a single revenue. Using a cash-only price range system can be a good way to start working in the course of sticking to a finances. This system typically uses envelopes for various areas of a finances like grocery money or fuel cash.

It lets you allocate your earnings to the important classes (like housing, food, and savings) and ensures that you don’t overspend in non-essential areas. Adopting a low-cost life-style requires a mix of sensible financial methods, disciplined habits, and lifestyle changes. Below are key methods that can assist you make the transition successfully. Millionaires usually have a tendency to have a credit card from almost each major issuer than less wealthy Americans, with Capital One being the only exception. This is likely due to wealthy Americans simply having extra bank cards than the common American. We provide you with a realistic view on precisely where you’re at financially so if you retire you understand how much money you’ll get every month.

Switching over to money solely allows them to raised manage their finances and see how they are spending their money. Their spending is uncontrolled, they have lots of debt, and need to make a change. If you want to rent a automobile, it’s highly unlikely that the corporate in query goes to simply let you lease a car with a money fee. With that stated, this is among the most necessary factors to contemplate if you’ve been trying to transfer to a cash solely system of paying off your monthly expenses.

One of the biggest advantages of residing a cash-only way of life is the power to construct a stronger monetary foundation for the future. By avoiding credit and debt, you’ll find a way to reside inside your means and put extra money towards financial savings and investments. One challenge with cash-only dwelling is managing your cash move effectively so that you at all times manage to pay for available for essential purchases. One strategy is to withdraw money initially of each week or pay interval based on the amount allotted in your price range for discretionary spending (i.e., groceries or entertainment). This method, you’ll have the ability to keep away from overspending by only using the designated amount of money out there. When we select to stay a cash-only way of life, we cut back our reliance on bank cards and debt overall.

Start notifying patients 3–6 months prematurely and handle their issues early. It’s inevitable that some patients won’t be able to keep whenever you cease accepting insurance coverage. That’s okay—your focus must be on supporting those that can and providing thoughtful alternatives for many who can’t. But for those categories the place you are able to use cash, determine the ones in which you’re persistently overspending. This may be groceries, leisure, eating out, or clothes. Everyone has their problem areas in relation to overspending.

Then there are the journeys to the bank to get the money out. But you will have enough cash in your account to cowl this expense, so it shouldn’t be an issue. You will start to determine on to spend cash on these items and not on most of the stuff you currently buy. The result of this shall be lowering your spending on many things you do not need. When you see you only have a sure amount of cash, you’ll suppose via your purchases a lot more. While solely using actual cash to pay for things has you miss out on this profit, you have to keep issues in perspective.

Once you determine how much revenue you’ll want in retirement, and the way a lot guaranteed income you’ll receive from Social Security and your pension, you can start to transition your portfolio to fill any shortfall. Taking the time to get your Social Security and pension strategies right can make an enormous distinction in how a lot income you’ll have the ability to count on to gather throughout your lifetime. Consider all your options – and what works for each you and your spouse — earlier than you declare these benefits. Finally, they acknowledged that their spending habits weren’t likely to be that much completely different than they had been throughout their final working years. Now, they spend deliberately on the issues that convey them joy and in the discount of on the issues that don’t matter. Successful retirees have ready both financially and emotionally for the following chapter of their lives.

We limit entry to your nonpublic personal information to our workers, contractors and brokers who need such access to supply services or products to you or for other legitimate business purposes. At the tip of each month, I try to make some mental notes about how every little thing went. I personally like to make use of a kind of mini increasing information to keep every little thing collectively and clearly labeled.

People there are more than pleased to share recipes, ideas, and help. It’s most likely greatest to avoid processed foods as much as attainable, but when they help you make the transition or round out your diet I say go for it. Gardein is considered one of my favourite meatless brands with a taste and texture that rivals the real factor (almost an excessive amount of for some!). There are as many causes for altering your food regimen as there are diets on the market. Whether you are making an attempt to lose weight, be healthier normally, or care a lot about animals, chopping out meat or other animal products from your food regimen can feel daunting at first.

You must also put your receipts into these envelopes so you can evaluate where you spent the cash on the end of the month. Alternatively, you probably can hold a operating ledger as you spend the money. The next step is to stop utilizing your debit card, bank card, and even your checkbook to pay for something in these categories—no matter what. The first step in switching to cash is to determine the budget classes that can really work as cash-only.

By being intentional with your spending and specializing in what actually issues, you’ll acquire financial freedom and peace of mind. Start small, stay constant, and don’t be afraid to tweak your system as you go. Remember, the objective is to make your cash give you the results you want, not the opposite way round. Transitioning to a cash-only finances is all about simplifying your funds and gaining better control over your spending.

Moreover, physically handling cash could make us extra aware of our spending habits, leading to higher monetary choices. Mindful spending additionally means being present and intentional when making purchases. Before buying something, we can ask ourselves if it aligns with our values and if it contributes positively to our lives.

You’ll also keep away from the entice of high-interest bank cards and other types of debt that can shortly spiral out of control. Let’s revamp our approach to finances by making intentional modifications to our spending habits. By allocating specific amounts of cash to totally different categories similar to groceries, leisure, or clothes, we will better management our spending and avoid overspending.

You’ll also be happier and have a better quality of life. Cash makes it easier to finances and stick to it It’s additionally an eye-opener and keeps you in reality as to how much cash is going out vs. coming in from week to week or month to month. These are only a few of the reasons why it’s higher to pay with money vs. a credit card.

Keep a easy pocket book or use a cash spending app to log every buy instantly. Use the envelope system by dividing your cash into classes like groceries, transport, and leisure. Spend only what’s in every envelope to stay within finances. And in case your financial situation is a large number, going to money only for a period of time can dramatically improve things.

When we monitor our expenses, we achieve perception into our spending patterns, permitting us to establish areas where we can cut back or reallocate funds to things that convey us larger joy and achievement. For month primary, you’ve transferred one or two expenses out of your credit card addiction to the cash-only virtual envelope system. This technique, should you can name it that, won’t work for everybody, but our price range is tight enough that it’s not overflowing.

“After running the numbers to get the web after-tax paycheck distinction, it wasn’t as massive as she thought,” Viktorin says. Outside her hours as a school principal, McNerney taught online programs, which boosted her checking account and granted her extra freedom to pursue her new professional path. “In order to have choices in your life, you have to have savings,” she says. If you are pondering of a career change at 40 or 50, listed beneath are 6 important steps to take.

People would come up and inquire about my services after classes person by particular person. Now this studio that I’m teaching at right here actually, I read so you probably can see that’s a full room and I offered out this workshop and I rented the space that means that this studio didn’t help me promote this workshop at all. It was all by way of my own promotion of my new e-mail list and social media.

Remember, you’re doing this to make your work much less annoying for you and better high quality in your shoppers. Adopting a cellular way of life means leaving behind a exhausting and fast address. A plan ensures a clean shift from traditional housing to full-time travel. Understanding the way to Transition to a nomadic lifestyle makes all of the distinction in comfort and safety. Start small – try utilizing only cash for purchases underneath a particular amount at first – then progressively improve the amount as you become more snug with the method.

Your physician will assist you to decide what’s finest in your physique and how you can make changes to your food plan in a means that helps your overall well being. When it involves the way to transition to a vegetarian food regimen, I’m going to begin this submit by saying this – I hate labels. Additionally, think about practical carbon footprint discount suggestions as a sensible step to enhance your minimalist journey. Banking products are supplied by Bank of America, N.A., and affiliated banks, Members FDIC, and wholly owned subsidiaries of BofA Corp.

Finding suitable healthcare suppliers and insurance policy is vital to make sure their well-being and financial safety. It is during this stage of transitioning that many veterans consider changing their Servicemembers’ Group Life Insurance (SGLI) coverage to a permanent insurance coverage policy, similar to entire life. One compromise could presumably be using money for every day bills while preserving a bank card for emergencies or large purchases. This hybrid strategy allows for higher spending control without chopping off entry to trendy conveniences.

Reaching out to enterprise and personal finance advisors early can contribute the peace of mind that comes with knowing what one’s next steps will be. When crafting a enterprise exit plan, it’s important to think about each business and personal monetary targets. Owners who have run a enterprise for some time may discover their identification is inseparable from their enterprise. As a outcome, planning to leave may bring concern of the unknown. Visualizing the longer term and writing down their long-term objectives and personal priorities may be the first step toward navigating the journey forward.

Yet these minor bills beat increasing bank card debt and harming one’s credit score rating. All it takes is a bit of time, planning, and an understanding that there are numerous instruments obtainable for those trying to avoid the vicious cycle of credit card debt. In simple phrases, when you stick to cash, you will not should pay extra cash in interest fees, which might add up if you use bank cards or loans. Avoiding interest costs is a giant plus, however it’s important to weigh the professionals and cons and contemplate your own monetary habits and needs earlier than going cash-only.

For higher or worse, there is no one-size-fits-all technique for funding your profession transition and deciding which avenue you’ll take is extremely specific to your distinctive situation. If your contract contains a non-compete clause, it’s crucial not to breach it by freely soliciting that info to the affected person or encouraging them to join your private apply. At the same time, patients are autonomous people and might make their own decisions! During your patient’s last appointment, you probably can casually point out, “By the way, this shall be my last appointment with you.

I’m largely enterprise coaching today, which you’ll hear everything I do is 100% business teaching. But I nonetheless have some cash-based physical remedy sufferers. I name them clients as a end result of they’re extra on the wellness side now. Some of them have been with me over a decade, paying me persistently. – Avoiding impulse shopping for; when you use money, it’s easier to stick to your price range and avoid making impulsive purchases that aren’t essential.

Related Posts

- สำนักงานศาลรัฐธรรมนูญ กับการมาถึงของยุค Ai Digital University

- Digital Financial System เศรษฐกิจรูปแบบใหม่ที่จะขับเคลื่อนเศรษฐกิจไทย

และ แนวทางที่ 8 คือ หากจะให้ดีกว่านั้น อัตราดอกเบี้ยควรมีการปรับลดลง ซึ่งช่วยบรรเทาภาระหนี้ของภาคครัวเรือน. เป็นประจำทุกปีที่ Techsauce จะจัดทำรายงาน Thailand Startup Ecosystem Report ซึ่งในปี…

- ไทยรัฐออนไลน์เปิดตัวสื่อใหม่ Thairath Cash อย่างเป็นทางการ

บุคคลสำคัญอีกคนหนึ่งคือ เศรษฐา ทวีสิน ซึ่งดำรงตำแหน่งนายกรัฐมนตรีและรัฐมนตรีว่าการกระทรวงการคลัง เกิดเมื่อวันที่ 15 กุมภาพันธ์ พ.ศ.2506 ที่กรุงเทพฯ เขาได้รับปริญญาตรีสาขาวิศวกรรมโยธาจากจุฬาลงกรณ์มหาวิทยาลัยในประเทศไทย ปริญญาตรีสาขาเศรษฐศาสตร์จาก University of Massachusetts ในสหรัฐอเมริกา…